Is financial success one of your resolutions in 2024? A cheap strategy according to successful millionaires is to expand your financial knowledge. Lucky for you, a little investment in books and time can set you ahead on this journey.

Your 20s are a crucial time for personal and financial development. It’s the age when you start growing rich. A good financial book can give you some valuable insights and practical advice for achieving your financial success.

In this blog post, we’ll give you a list of the best finance books in Kenya to read in your 20s if you are seeking to grow financially.

Read Next: Which are the Best Books for Personal Development & Finance Success?

Think and Grow Rich

by Napoleon Hill (1937)

Napoleon Hill’s timeless classic, “Think and Grow Rich,” is a must-read for anyone aspiring to achieve success and financial prosperity.

Despite being written many decades ago, the principles outlined in this book remain relevant. Hill explores the power of positive thinking, goal-setting, and the importance of a burning desire to achieve your financial goals.

As a young adult in Kenya, you can draw inspiration from the stories and principles shared in the book to cultivate a mindset that leads to sustainable financial success.

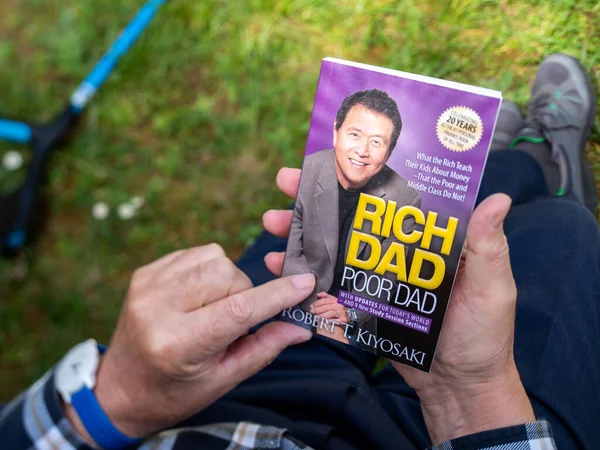

Rich Dad Poor Dad

by Robert T. Kiyosaki (1997)

“Rich Dad Poor Dad” by Robert Kiyosaki is the best book on personal financial literacy and education.

Through a comparison of two father figures, the book highlights the significance of investing, entrepreneurship, and building assets in financial success. For young Kenyans, grasping the difference between assets and liabilities, a key theme in the book, can be a game-changer in your journey toward financial independence. Kiyosaki’s insights encourage a mindset shift, showing that true wealth often comes from making smart financial moves and strategic investments.

This book serves as a valuable guide for you if you are looking for a more informed and empowered approach to managing your finances.

The Richest Man in Babylon

by George Samuel Clason (1926)

Set in ancient Babylon, this book offers you timeless financial wisdom through a collection of parables and fables.

Each story imparts essential lessons on saving, investing, and making wise financial decisions. The principles discussed, such as “Start thy purse to fattening” and “Make thy gold multiply,” can be directly applied to the financial landscape in Kenya. Clason’s book is a valuable resource for youth in Kenya who are looking to understand the fundamentals of wealth creation and financial discipline.

The Simple Path to Wealth

by JL Collins (2016)

Is your goal early retirement?

JL Collins presents a straightforward and no-nonsense approach to achieving financial independence and retiring early. His investment philosophy focuses on simplicity and long-term thinking. It is the best financial book if you are a young Kenyan who is just beginning your financial journey. The book covers the basics of investing in the stock market and provides actionable advice on building a solid financial portfolio.

It’s an excellent starting point if you are looking to understand the power of investing for long-term wealth creation.

Psychology of Money

by Morgan Housel (2020)

Do you know that understanding financial psychology and behavior can be the best tool for financial success?

Morgan Housel delves into the psychological aspects of money, exploring the behaviors and biases that influence your financial decisions. This book is particularly relevant for you in Kenya, as it helps you understand how emotions can impact your financial choices. By gaining insight into the psychology of money, young individuals can make more informed and rational decisions about budgeting, investing, and saving for the future.

I Will Teach You to Be Rich

by Ramit Sethi (2009)

Ramit Sethi’s book is a hands-on guide covering various personal finance topics, including budgeting, saving, investing, and entrepreneurship.

Written in an engaging style, it is well-suited for young Kenyans looking to take charge of their financial lives. Sethi emphasizes the significance of automating financial processes and making conscious choices aligned with personal values and goals.

This book provides practical advice and a strategic approach to empower individuals in Kenya to manage their money effectively and work towards financial success.

Get Good with Money: Ten Simple Steps to Becoming Financially Whole

by Tiffany Aliche (2021)

Tiffany Aliche, also known as “The Budgetnista,” provides a step-by-step guide to attaining financial wellness.

Her book tackles common financial challenges for young individuals, including student debt, budgeting, and building an emergency fund. Packed with actionable tips and relatable anecdotes, it is an excellent resource for a Kenyan youth aiming to overcome financial hurdles and establish a solid financial foundation.

Personal Finance in Your 20s For Dummies

by Eric Tyson (2018)

Geared for young adults, Eric Tyson’s book simplifies complex financial concepts, making them accessible for those starting their financial journey.

Covering budgeting, debt management, and investing, it’s an excellent resource for Kenyan youth seeking practical advice. Tyson’s clear presentation ensures readers can grasp fundamental principles without feeling overwhelmed. The book provides a foundation in financial literacy and actionable steps for successful financial navigation.

With a focus on budgeting, debt management, and investing, Tyson’s book equips young readers with essential skills for a secure financial future.

The Money Book for the Young, Fabulous & Broke

by Suze Orman (2005)

Suze Orman’s book is like a helpful friend for young people facing money challenges.

It gives straightforward advice on managing debts, saving money, and making smart investments. For a Kenyan youth working towards financial stability, Orman’s emphasis on building a strong money foundation is like a roadmap to success. The book encourages making wise decisions, guiding readers to set themselves up for a financially secure future.

With practical tips, Suze Orman’s insights make handling money easier and more achievable for young individuals in Kenya.

The Millionaire Next Door

by Thomas J. Stanley and William D. Danko (1996)

Have you heard that “ imitation is the best way to learn?” in the book, “The Millionaire Next Door” you have a deep dive view into the habits and traits of millionaires, breaking common myths about wealth.

Through thorough research, it challenges what people usually think about being rich. The principles it shares can motivate you as a Kenyan youth to embrace a smart and disciplined financial strategy. It emphasizes the value of spending less than what you earn and making wise investment decisions. This book also encourages a frugal mindset, showing that wealth isn’t always about flashy lifestyles but often about making thoughtful financial choices.

For young individuals in Kenya, it serves as a guide to build lasting prosperity by adopting practical and sustainable financial habits.

Your Money or Your Life

by Vicki Robin and Joe Dominguez (1992)

Is time money? In the revolutionary book, “Your Money or Your Life” you are prompted to rethink the connection between time, money, and life contentment.

The authors lay out a nine-step program, guiding readers to transform their relationship with money and attain financial independence. A Young Kenyan can find resonance in this book, especially if you are looking for a comprehensive approach to financial well-being. It stresses the importance of aligning spending habits with personal values and life goals. The guide will give you a holistic perspective on managing money.

If your goal is to have a more meaningful and fulfilling financial journey, this book provides practical steps to a balanced and purposeful approach to finances.

The Total Money Makeover

by Dave Ramsey (2003)

Dave Ramsey’s “The Total Money Makeover” is a hands-on guide for those aiming to get rid of debt, establish an emergency fund, and reach financial freedom.

Ramsey’s “Baby Steps” approach simplifies the money management process, offering a clear roadmap to financial success. For young Kenyans eager to steer their financial destiny and strive for a debt-free future, this book can be especially beneficial. Ramsey’s practical advice and structured plan provide actionable steps for individuals in Kenya to regain control of their finances and work toward long-term financial security.

Conclusion

Embarking on your financial journey in your 20s is a pivotal step toward securing a stable and prosperous future.

The 12 best financial books mentioned above provide a wealth of knowledge and practical advice tailored for young Kenyans. These books offer valuable insights that can empower you to make informed financial decisions.

Remember, financial success is a journey, and arming yourself with knowledge is a crucial step towards achieving your goals.

Related: Can Sun Tzu’s “Art of War” make you a better business Leader?